Here is what you need to know.

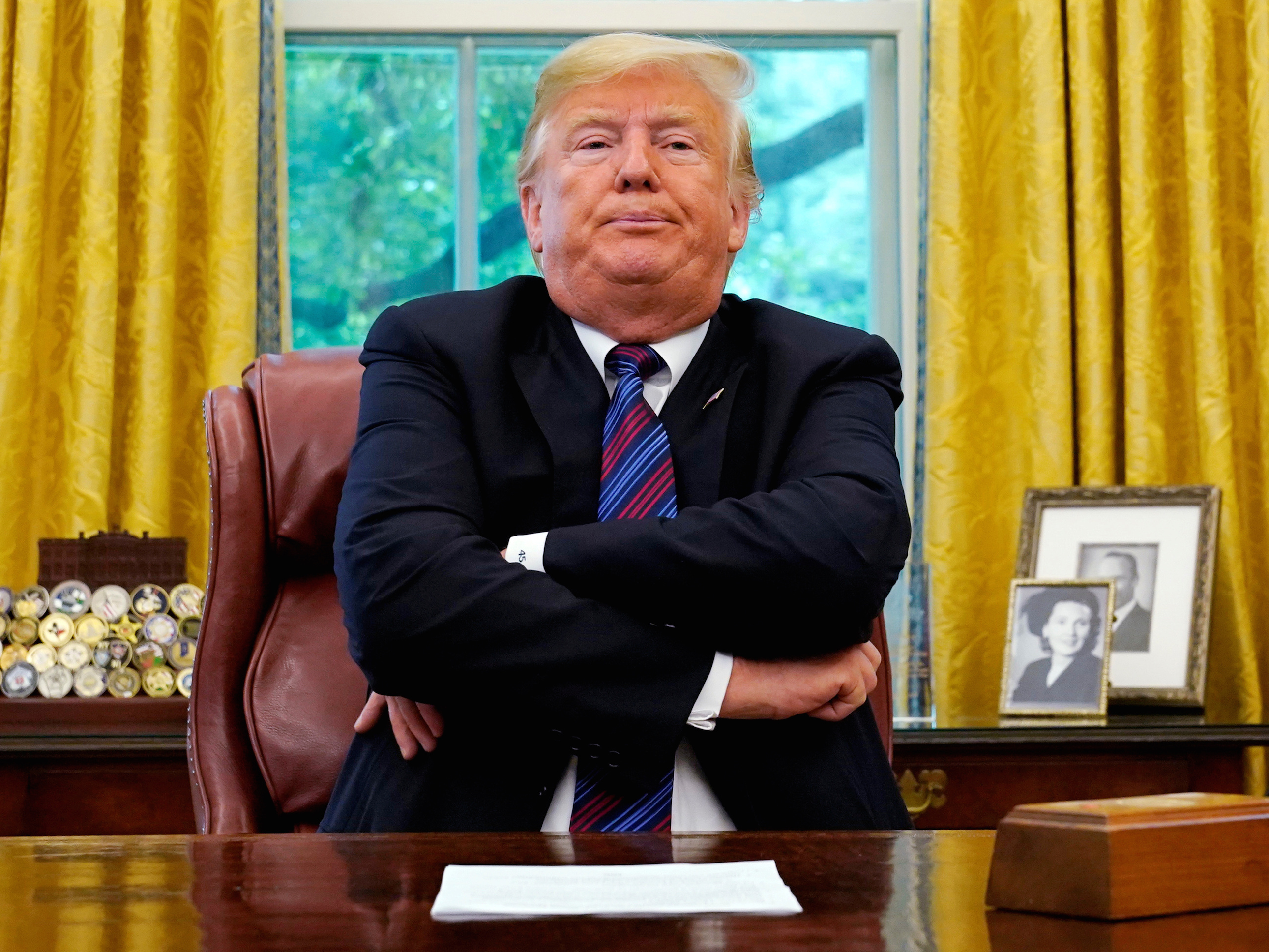

The US and Mexico move to overhaul NAFTA. A preliminary agreement says 75% of a tariff-free car must originate in a NAFTA country (up from 62.5%) and that 40% to 45% of a car or truck’s content must be made by workers earning more than $16 an hour.

The Trump administration is throwing $4.7 billion at US farmers to try to make up for trade-war pain. Soybean farmers – who have been hit particularly hard by the US’s trade war with China – are to receive $3.6 billion of aid.

Aramco has lost its unlimited access to Saudi Arabia’s oil reserves. The state-run oil giant had its access to the kingdom’s oil and gas reserves reduced to a 40-year supply, the Financial Times says.

Cryptos saw an overnight boost. Dash – which has become somewhat of an alternate-transactions platform in Venezuela – spiked more than 20% overnight before paring its gains.

The stock market's record-breaking run is masking a dangerous trend. The rally into record territory has occurred without participation from some key tech stocks that had propelled the market high, Morgan Stanley says.

Warren Buffett's Berkshire Hathaway is entering a $1 trillion market in India. Berkshire confirmed on Monday that it was investing in One97 Communications Ltd., the parent company of Paytm, which is the largest mobile-payment company in India.

Toyota is investing in Uber as part of a self-driving car partnership. Toyota's $500 million investment values Uber at $72 billion, according to The Wall Street Journal.

Stock markets around the world are higher. Hong Kong's Hang Seng (+0.28%) led the gains in Asia, and Britain's FTSE (+0.37%) is out front in Europe. The S&P 500 is set to open little changed near 2,899.

Earnings reports keep coming. Best Buy and Tiffany report ahead of the opening bell.

US economic data flows. S&P home prices will be released at 9 a.m. ET and consumer confidence will cross the wires at 10 a.m. ET. The US 10-year yield is unchanged at 2.85%.